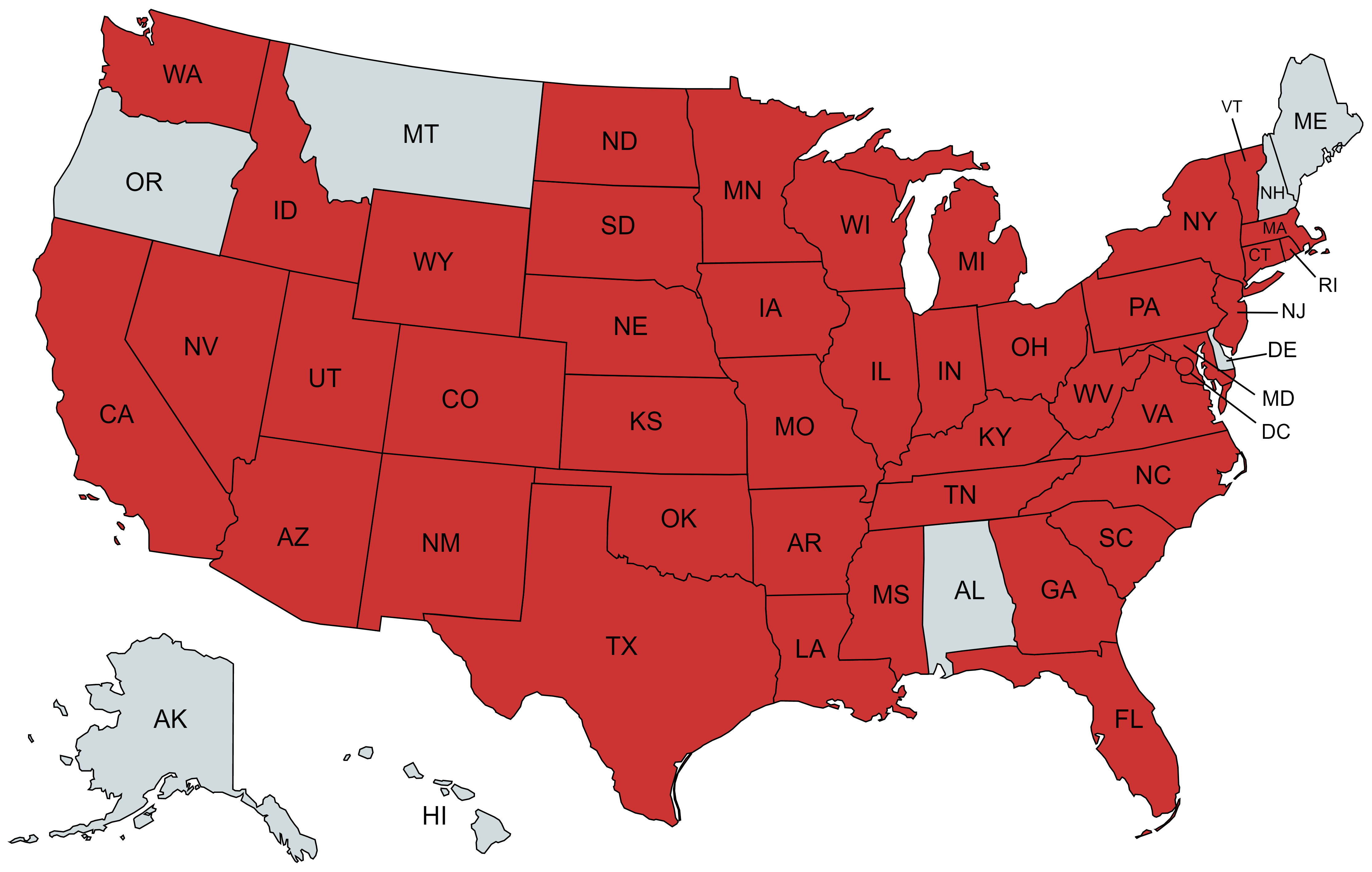

Williams Furnace Parts is required to collect sales tax in all states with the exception of Alabama, Alaska, Delaware, Hawaii, New Hampshire, Maine, Montana and Oregon.

If your order is shipping to a state that does not require sales tax to be charged at the time of sale, you may still be required to report non-taxed purchases on your state tax return. You may also be responsible for replacement sales tax or use tax. Please check with your state’s Department of Revenue for details.

If you are tax exempt in one of these states and would like to make a tax exempt purchase, you must complete the form below before making your purchase. Sales tax cannot be removed from an order that was already placed. Once the proper information has been submitted, please allow our team 1-2 hours (during business hours) to process the request and apply tax exempt status to your account. You will be sent an email once this process is complete.

Please complete the following questions and upload your signed completed exemption certificate before completing your order.